ETH Price Prediction: $4K Breakout Imminent as Technicals and Fundamentals Align

#ETH

- Technical Breakout: ETH price approaches upper Bollinger Band with MACD showing reduced bearish momentum

- Institutional Demand: BlackRock's $10.2B position and record CME open interest signal strong capital inflows

- Network Growth: L2 dominance and $295M staking expansion provide fundamental support

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

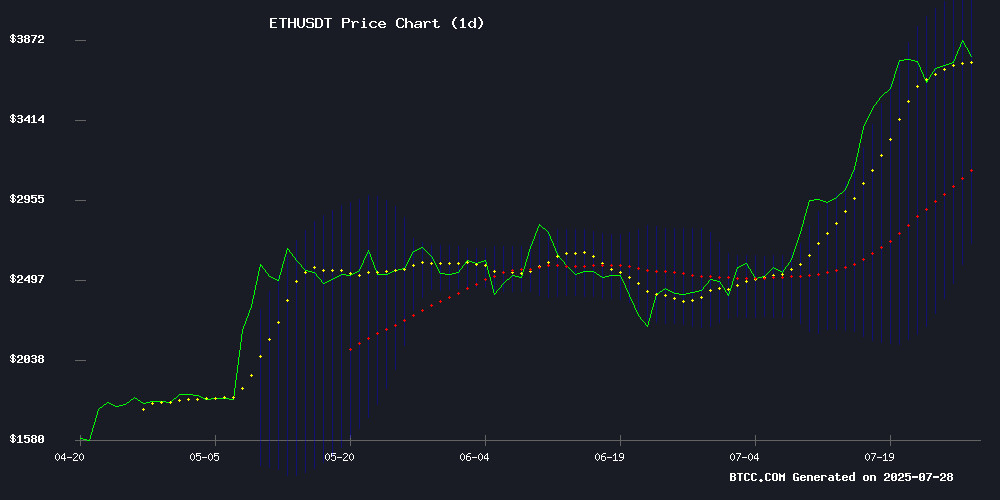

According to BTCC financial analyst Ava, ethereum (ETH) is showing strong bullish signals as it trades at $3,939, significantly above its 20-day moving average of $3,430.49. The MACD indicator, though still negative, is converging (-549.26 vs. -505.91), suggesting weakening downward momentum. Notably, ETH is approaching the upper Bollinger Band at $4,166.89, which could act as immediate resistance. A sustained break above this level may confirm a new uptrend.

Ethereum Market Sentiment: Institutional FOMO Meets Network Growth

BTCC's Ava highlights overwhelmingly positive sentiment as institutional players like BlackRock double Ethereum holdings to $10.2B while Layer 2 solutions demonstrate robust adoption. The combination of ETF inflows, a $295M staking position expansion by SharpLink Gaming, and Base's dominance in L2 revenue creates fundamental support for ETH's $4K retest attempt. However, Ava cautions that record-high $7.85B CME futures open interest indicates potential overheating risks.

Factors Influencing ETH's Price

SharpLink Gaming Expands Ethereum Staking Position with $295M Purchase

SharpLink Gaming has acquired an additional 77,210 ETH worth $295 million, bolstering its ethereum holdings to 438,017 ETH ($1.69 billion). The move signals deepening institutional confidence in Ethereum's staking ecosystem.

On-chain data reveals the company transferred $145 million USDC to Galaxy Digital earlier this week, with subsequent withdrawals of 38,600 ETH from Binance. "This likely completes the ETH purchase," noted analyst EmberCN, referencing the strategic accumulation.

The gaming firm now stakes over 95% of its ETH position through liquid staking protocols. Crypt Rover suggests such institutional inflows could propel ETH toward $10,000, citing the asset's 3% price surge following the disclosure.

Ethereum Exit Queue Surge Exposes Fragility in Liquid Staking Markets

Ethereum's validator exit queue has ballooned since mid-July, revealing structural vulnerabilities in liquid staking markets. The surge wasn't driven by speculative profit-taking but by a liquidity crunch that sent ETH borrow rates on AAVE skyrocketing from 2-3% to as high as 18%.

The spike flipped the spread between staking yields and borrowing costs negative, rendering Leveraged staking strategies unprofitable overnight. Traders who had deposited Liquid Staking Tokens (LSTs) or Liquid Restaking Tokens (LRTs) as collateral to borrow ETH were forced to unwind positions, triggering a cascade of selling pressure.

As participants rushed to deleverage, they either swapped LSTs/LRTs for ETH at discounted rates or initiated unstaking to redeem at par value. This flood of exits overwhelmed Ethereum's validator queue, exposing the fragility of yield-amplification strategies in volatile market conditions.

Ethereum Price Eyes $4K Again – Will This Be the Breakout That Sticks?

Ethereum's price has surged past the $3,800 resistance level, signaling renewed bullish momentum. The cryptocurrency now trades above $3,820, supported by a key trend line at $3,800 on the hourly chart. Market observers are watching for a potential push toward $4,000.

The latest uptrend follows a steady climb from the $3,515 swing low, with ETH testing the $3,900 zone before consolidating. Technical indicators suggest strength, with the price holding above the 100-hourly Simple Moving Average. A decisive break above $3,950 could pave the way for a retest of the psychological $4,000 barrier.

Ethereum Nears 10-Year Uptime Milestone Amid Scaling and Legal Debates

Ethereum approaches its 10th anniversary with an unbroken record of zero downtime, a feat highlighted by the community as a testament to its resilience. The network commemorated the milestone with an NFT torch, symbolically passed among users in the lead-up to the celebration.

Binji Pande, a contributor to the Ethereum Foundation and Optimism, underscored Ethereum's uninterrupted operation over the past decade, contrasting it with outages experienced by centralized platforms like Facebook and AWS. "Every centralized giant blinks," Pande noted, emphasizing Ethereum's decentralized robustness.

Despite the celebratory tone, critics continue to question Ethereum's scalability solutions and regulatory risks. The network's ability to maintain uptime while navigating these challenges remains a focal point as it enters its second decade.

MoonBull Whitelist Opens for Ethereum-Based Meme Coin $MOBU Amid Market Frenzy

MoonBull ($MOBU), a new Ethereum-based meme coin, has launched its whitelist with claims of 1000x potential. The project combines DeFi utilities with meme culture, targeting early adopters through exclusive staking rewards and token bonuses. Competing meme coins like Sudeng and Goatseus Maximus have demonstrated resilience during recent market volatility.

The whitelist offers preferential pricing and access to undisclosed token distributions. Market observers note parallels to previous meme coin frenzies, though MoonBull emphasizes its hybrid DeFi-meme architecture as a differentiator. No major exchanges have yet announced listings for $MOBU.

Base Dominates Ethereum Layer 2 Revenue Race with Innovative Fee Model

Base, the Coinbase-backed Ethereum LAYER 2 network, has surged ahead of competitors, generating an average of $185,291 in daily revenue over the past six months. This performance dwarfs Arbitrum's $55,025 and the combined $46,742 of 14 other leading Layer 2 solutions.

The network's edge stems from its EIP-1559-inspired fee mechanism, which replaces rigid first-come-first-served processing with dynamic auction-based prioritization. Transactions are sequenced by highest priority fee per gas unit, allowing users to bid for urgent execution—a system that efficiently monetizes block space demand.

Ethereum's Pectra upgrade further boosted Base's advantage by reducing Layer 1 data costs through blob transactions. While Arbitrum introduced Timeboost for express processing, its fixed-rate model proves less responsive to demand spikes than Base's real-time bidding approach.

Priority fees alone contribute $156,138 daily—86% of Base's total revenue—demonstrating the network's mastery at capturing value during periods of heightened activity. This economic design has secured Base's position as the most profitable rollup in Ethereum's scaling ecosystem.

Ethereum Price Analysis: Is ETH Gearing Up for a Surge to $4K?

Ethereum's bullish momentum remains intact as the cryptocurrency flirts with a critical resistance level. Spot prices consistently trade above key moving averages, fueled by a robust rally from June lows. Market participants now watch for a potential breakout above $4,107—a MOVE that could signal further upside toward the $4,400 historical peak.

Technical indicators reinforce the optimistic outlook. The daily chart shows ETH successfully converting the $3,300 zone from resistance to support, while the 100-day and 200-day moving averages form a golden cross. Although the RSI hints at overbought conditions, the sustained reclaim of prior highs underscores strong buyer conviction. Any dip below $3,300 WOULD threaten the bullish thesis, but current market structure suggests continued upward trajectory.

Institutional Whale Accumulates $114M in Ethereum Amid ETF Inflows

Ethereum is quietly witnessing significant institutional accumulation despite a seller-dominated spot market. Wallet 0xF436—linked to DeFiance Capital—scooped up 30,366 ETH ($114M) within 28 hours, coinciding with renewed ETF inflows. This suggests growing institutional conviction even as retail activity falters.

Futures markets tell a divergent story. Top trader TheWhiteWhaleHL maintains $181M in open long positions with $33M unrealized profit, demonstrating resilience after recent liquidations. The growing chasm between weak spot demand and leveraged Optimism raises questions about ETH's next directional move.

Ethereum CME Futures Open Interest Hits Record $7.85B – Is ETH Overheating?

Ethereum is entering a powerful new chapter in its market cycle. After months of underperformance, ETH has surged over 175% since late April, reclaiming momentum and investor attention. Open Interest on CME Futures reached an all-time high of $7.85 billion, signaling heightened institutional activity and potential volatility ahead.

Analysts warn of overbought conditions as Ethereum approaches key resistance zones. Yet, with ETH outperforming Bitcoin and altcoins moving in tandem, many see this as the start of a broader altcoin cycle. Derivatives data suggests continued strength, but traders are bracing for larger moves.

Ethereum-Based DeFi Token Mutuum Finance (MUTM) Surpasses $13.5M in Presale

Mutuum Finance (MUTM), an emerging Ethereum-based DeFi token, has crossed the $13.5 million mark in its presale, signaling strong investor interest. The project aims to enhance capital efficiency through trustless mechanisms, positioning itself at the forefront of decentralized finance innovation.

The milestone underscores growing confidence in Ethereum's DeFi ecosystem, with Mutuum Finance leveraging the network's robust infrastructure to attract capital. The presale performance suggests a bullish outlook for niche DeFi tokens offering novel solutions.

BlackRock Doubles Ethereum Holdings to $10.2B Amid Institutional FOMO

BlackRock, the world's largest asset manager, has aggressively expanded its Ethereum portfolio, acquiring over 1 million ETH worth $3.76 billion in just three weeks. The firm's total holdings now stand at 2.8 million ETH, valued at $10.22 billion—a clear signal of institutional conviction in the cryptocurrency's long-term potential.

The buying spree mirrors broader institutional momentum. U.S. spot Ethereum ETFs saw $4.4 billion inflows in July alone, eclipsing full-year 2024 totals. This surge reflects what analysts describe as a 'FOMO month' for ETH, with institutions scrambling for exposure before anticipated price appreciation.

Ethereum's market performance validates the enthusiasm. The asset broke through $3,500 resistance to hit $3,817 on July 21—a 53.69% monthly gain—fueled by demand for investment products and optimism around network upgrades. The DeFi ecosystem's maturation continues to attract sophisticated capital.

Is ETH a good investment?

Ethereum presents a compelling investment case according to BTCC's Ava, with technical and fundamental factors converging:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20MA | +14.8% premium | Strong bullish momentum |

| MACD Histogram | -43.35 | Bearish but improving |

| Bollinger Position | Upper band $4,166 | Breakout potential |

| Institutional Flow | $114M whale accumulation | Strong demand |

While the $4K resistance remains key, Ethereum's staking growth, Layer 2 adoption, and institutional interest create favorable risk-reward dynamics. Short-term traders should monitor Bollinger Band reactions, while long-term investors may benefit from dollar-cost averaging given the strong fundamentals.